The Quest for Useful and Credible IoT information

If you believe the headlines from vendors, analysts and business press, the adoption of the Industrial Internet of Things (IoT) is going strong and accelerating, and companies in practically every industrial sector are jumping on the IoT bandwagon and investing heavily in developing IoT products and services.

The reality is more of a mixed bag. Indeed, many companies are moving forward, investing, experimenting, and are well on the way to harvest the business value of the Industrial IoT. But many more companies are still on the fence. They may have dipped their toes in the water by investigating the opportunity and perhaps attempting a modest proof of concept, but have not dared moving forward and implemented a full-scale system.

What’s the difference? What do organizations demonstrating success know that others do not? What prevents some companies from progressing beyond a proof of concept to a full-blown IoT implementation?

Being an exciting and rapidly evolving space, there is no shortage of opinions, business guides, and technical information about the Industrial Internet of Things. But how useful is this information? How reliable?

We collaborated with The Peggy Smedley Institute on a very short market survey to learn about the perceptions and opinions of about IoT information available from technology vendors, consultants, professional organizations, and other sources. Survey participants were individuals and companies in different stages of IoT implementation.

Is Information about IoT Useful? How Credible is it?

All and all, there is wealth of information about IoT from vendors, systems integrators, and consultants. Analyst firms also publish opinions and forecasts about IoT market trends on a regular basis. And there’s no shortage of scientific and business research coming from academia.

But, as can be expected in a fast-moving and overly-hyped space, the depth, credibility and usefulness of this torrent of information varies dramatically, and runs the gamut from trustworthy and useful data to useless hyperboles and shallow regurgitation of the obvious.

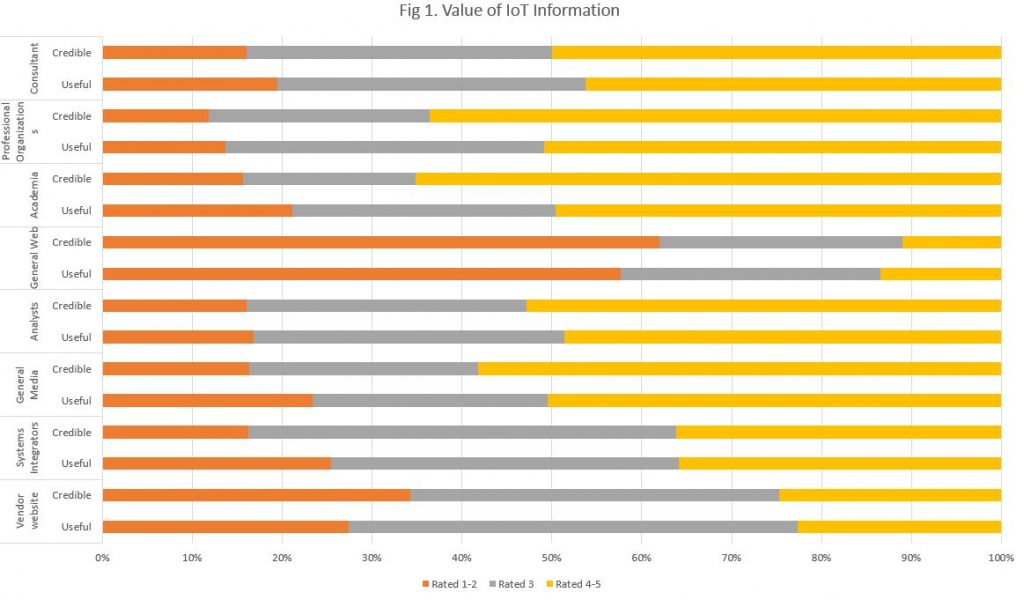

Figure 1 shows the ranking of different information sources for their perceived usefulness and credibility. Respondents were asked to rank each source on a scale of 1 to 5, with 1 being the least useful or credible and 5 being the most.

As the data shows, in general, respondents ranked most information sources as reasonably useful and credible. But a closer observation reveals several subtle, yet meaningful insights.

Analysts, Professional Organizations and Academia

Information from academia, professional organizations (e.g. the Industrial Internet Consortium) and, to a somewhat lesser degree, IoT consultants, ranked as most credible and useful.

Information published by analyst firms such as Gartner and IDC also ranked high, although not as credible as information available from academia, professional organizations, and IoT consultants.

The fact that survey respondents ranked information from academia and analysts highly isn’t surprising. But it is interesting to note that coverage by reputable mainstream media such as Forbes, The Wall Street Journal and Wired, which cover the topic only occasionally, are considered by survey respondents more credible and as useful as the information available from highly specialized analysts and consultants.

IoT Vendor Ranking

It is expected that early adopters will rely heavily on technical and business information they receive from IoT technology providers such as PTC and GE Digital. But in this survey, IoT vendors ranked surprisingly low. They get more negative opinions (rank 1-2) and the fewer high ranking (4-5) than any other groups in the survey, with the exception of general websites that do not profess to offer IoT expertise.

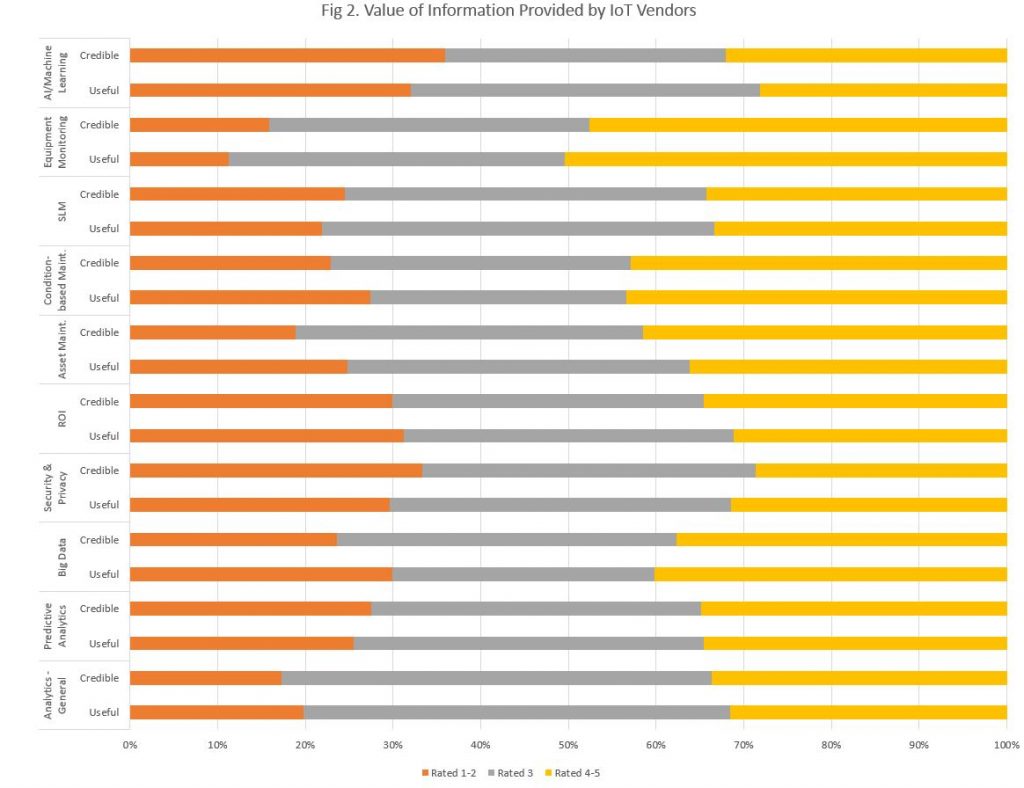

We assume that technology vendors are the de facto go to source of IoT-related information. Figure 2 shows how respondents ranked the information IoT vendors offer about some key IoT technology and business topics.

Service Lifecycle Management

Equipment monitoring, condition-based maintenance, and asset maintenance are often touted as the “killer apps” of the Industrial IoT technology. And, as you might expect, vendors-supplied information about these topics was ranked the highest. On the other hand, information concerning service lifecycle management (SLM), which provides the business context for IoT service-related functions, received only mixed reviews, with many respondents remaining lukewarm about the value of this information. In the same vein, information addressing the economic benefits of the Industrial IoT and return on investment (ROI) analyses also received relatively poor ranking.

Data Analytics

IoT vendors spend significant resources promoting data analytics, and, in particular, predictive analytics, usually as part of the SLM narrative. Despite these efforts, the opinions about the usefulness and credibility of analytics were mixed, and split almost equally between respondents that ranked this information high (4-5), just OK (3) and low (1-2). A similar split was observed in respondents’ evaluation of the information concerning artificial intelligence (AI) and machine learning.

This split is likely a reflection of the complexity of these technologies and the wide range of industry adoption and implementation maturity.

Data Security

Market studies show that data security ranks among the top concerns and barriers to adoption of IoT technology. Our survey shows a relatively high level of dissatisfaction with vendor information concerning data security and privacy: about 30% of survey respondents graded information they receive from vendors relatively low.

What Information is Most Needed?

Judging by the information presented in Figures 1 and 2, about a quarter of the respondents are not entirely satisfied with the information available to them (from any source), as they do not find it sufficiently credible or useful.

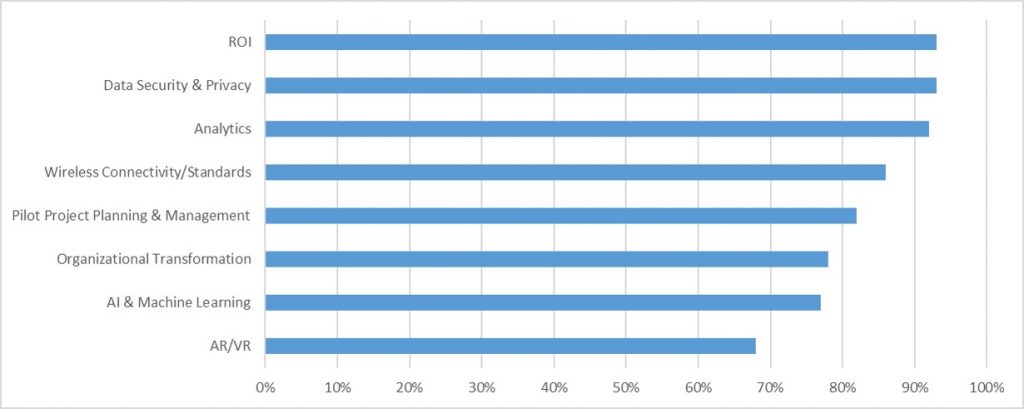

What information is useful? Figure 3 shows the responses of the survey participants when asked what information would be most desirable, regardless of its source.

As expected, early adopters seek more information—from any credible source—about data security and privacy.

Survey respondents also seek more information about data analytics. As we saw earlier, there appears to be a wide range of knowledge about the subject and technology maturity. The high level of interest may be an indication of recognition of the critical role of data analytics in utilizing IoT data even on the part of early adopters.

On the other hand, when it comes to another IoT hot topic: artificial intelligence and machine learning, survey respondents show much less interest, despite the attention given to the topic by technology vendors and analysts, which appear to be ahead of the market.

Markers of an Early Adopters Market

The findings of this survey indicate that despite the heightened activity and extensive coverage, the Industrial Internet of Things still bears the markers of a nascent space with fairly inconsistent levels of technology maturity, and even greater disparity in business maturity.

A key indication we are in an early-adopters market is the focus on technology topics and the lack of strong interest in project management and digital transformation topics that are critically important in reaping the value of connected assets. The interest in ROI modeling isn’t necessarily contradictory—these are early adopters seeking help to justify proofs of concept and pilot projects.

The IoT and the Outcome Economy

As I discussed in The Outcome Economy, IoT isn’t a technology; it is a transformative business strategy. Most IoT vendors have a strong technical background and many years of selling technical solutions but not always a commensurate level of enterprise business acumen. As organizations mature to exploit Industrial IoT technology to drive the connected enterprise, they will need solid guidance and credible information concerning business model innovation, enterprise decision making, and digital transformation.

The survey exposes a meaningful lack of the information that might be advantageous in helping early adopters mature more quickly from technology-centric proofs of concept to realizing large-scale outcome-based business models leveraging IoT technology.

IoT ecosystem members and, in particular, IoT technology vendors, need to invest in developing a corpus of information: credible and relevant outcome-based business models, implementation frameworks and case studies. These must strike a balance between “cool” technologies whose time hasn’t come yet and meaningful business applications that product companies can implement and realize the business and financial gains they expect from the Industrial Internet of Things.

Image: The Inspiration of Saint Matthew by Caravaggio (1602)